Maintaining superior levels of quality care is what you’ve built your cardiology practice on. But changes in cardiology medical coding, billing and collections, specifically related to medical record auditing, have emerged that can create challenges for your practice if you haven’t fully prepared.

The quality of care provided by any cardiology practice is based on the accurate and complete clinical documentation of medical records. However, changes to the auditing standard have occurred to ensure that accuracy. Has your practice fully transitioned to SSAE 16? Developed in 2011 by the American Institute of Certified Public Accountants (AICPA), this new auditing standard replaces SAS 70 to keep pace with the growing acceptance of international accounting standards.

Bottom line, the quality of care provided by any cardiology practice is based on the accurate and complete clinical documentation of medical records.

Chart auditing may seem intimidating, but there are many positive aspects of chart auditing including increased revenue, treatment efficacy research, and peace of mind in the event of third party audits. New regulations from the OIG, RACs, and other third-party auditors make your chart auditing critical to maximizing compliance and revenue in your cardiology revenue cycle management.

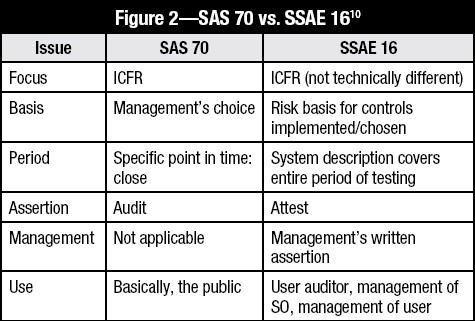

The differences between the old and the new standards are best reflected in this chart.

New regulations can be a burdensome and sometimes even impossible task to implement. Without them, they’re costing your cardiology practice more than you realize unless you have the right cardiology revenue cycle management company that specializes in cardiology auditing and compliance regulations.

According to the AAPC, benefits to medical audits:

- Determine outliers before large payers find them in their claims software and request an internal audit be done.

- Protect against fraudulent claims and billing activity

- Reveal whether there is variation from national averages due to inappropriate coding, insufficient documentation, or lost revenue.

- Help identify and correct problem areas before insurance or government payers challenge inappropriate coding

- Help prevent governmental investigational auditors like recovery audit contractors (RACs) or zone program integrity contractors (ZPICs) from knocking at your door

- Remedy undercoding, bad unbundling habits, and code overuse and to bill appropriately for documented procedures

- Identify reimbursement deficiencies and opportunities for appropriate reimbursement.

- Stop the use of outdated or incorrect codes for procedures

- Verify ICD-10-CM and electronic health record (EHR) meaningful use readiness

It’s essential for your cardiology practice to have an expert in cardiology revenue cycle management, one that has completed special audit training and is fully versed in SSAE 16 implementation. A total quality improvement system is just what a third party, independent revenue cycle management company like revMD is specialized to implement, making chart auditing an essential component of a cardiology practice compliance plan.

Certified third party independent medical coding and billing services such as revMD with specialization in cardiology medical coding, billing and collections, are essential these days because of all the changes in compliance and audits. revMD has successfully completed an extensive examination, a SSAE 16 (Service Organization Control (SOC)) 1 Type II audit, conducted by an independent accounting firm. The audit examines the effectiveness of internal controls supporting CDS Legal’s e-discovery services.